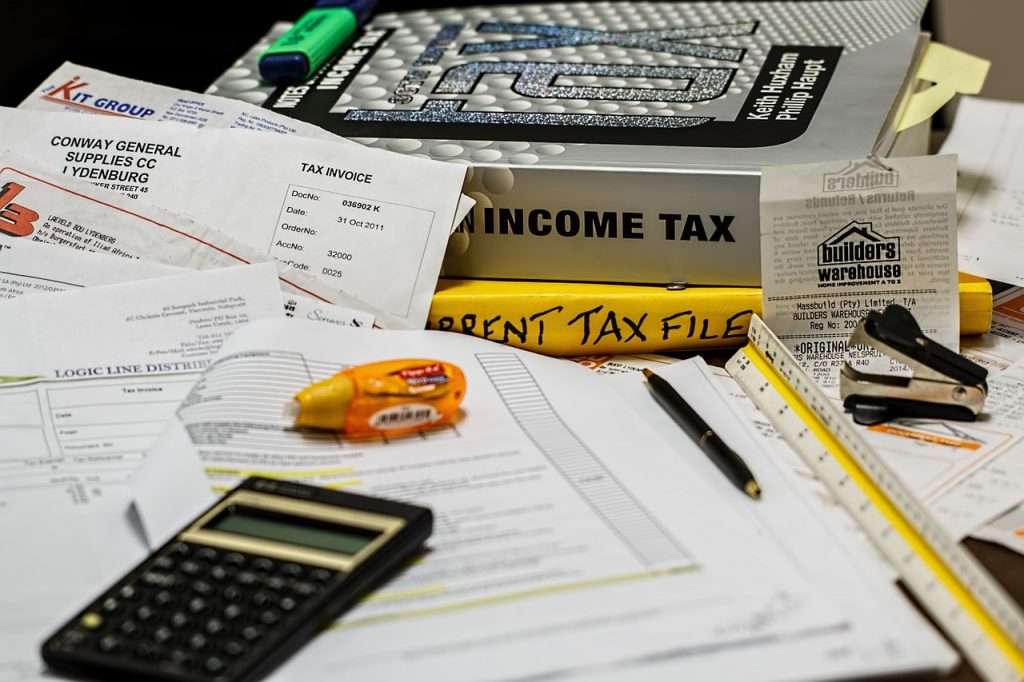

Filing Your Taxes Just Got A Whole Lot Harder

The IRS is warning that filing your taxes this year is poised to be harder than ever before.

This article is more than 2 years old

Only two things in life are certain – death and taxes. Cliché? Yes. True? Unfortunately. While neither certainty is particularly comforting, at least death is something that (generally) one only has to endure once. Taxes on the other hand are a yearly inevitability, and this year, according to NPR, they are about to get a whole lot harder to get done.

The IRS is warning individuals that it’s going to be harder than ever to file their taxes this year largely because of the upsets the pandemic caused during last year’s tax season. The year 2020 was a difficult tax year because many had to take into account COVID relief payments and pandemic-related childcare tax credits. These unique circumstances added to the IRS’ tax load, a load that it is still trying to trim down. The National Taxpayer Advocate reported that the IRS is behind on nearly 35 million returns dating back to 2020. Hence, all the new filings coming in for 2021 will only add to that load. What this translates to is that individuals will likely have to wait much longer than average to receive their 2021 tax refunds.

Complicating matters more is the fact that the IRS is severely understaffed, which only further inhibits its ability to process returns efficiently. Deputy Treasury Secretary Wally Adeyemo asserted “It is going to be, unfortunately, a frustrating tax season.” Additionally, The National Taxpayer Advocate also pointed out that over the past 10 years the IRS has lost about 20% of funding from the Federal Government. Lack of staff combined with waning resources is a recipe for a tax filing debacle.

Despite all of the concerns and expectations surrounding how hard it will be for taxpayers to file this year, Adeyemo did offer some words of advice to help make the process a little bit smoother. “What that means for taxpayers is that they need to make sure that they file online, that they take steps to make sure that their returns are prepared…” said Adeyemo. He also noted that people should keep their eyes peeled for letters and instructions relating to tax information on stimulus checks and child tax credits. Additionally, those without internet access should visit a Free Tax Preparation Center to ensure the quickest and most efficient offline experience.

Even though this tax season is one that is poised to be an exceedingly difficult one in which to file your taxes, there are glimmers of hope for future tax seasons to be better. In the Biden Administration’s Build Back Better Act, there is a section that allows for an allocation of an additional $80 billion in funding to the IRS. Should the IRS receive this funding they could vastly enhance their aging infrastructure and greatly improve how quickly they can process returns.

Moreover, Adeyemo even believes that the extra funding could help to close the disparate tax gap between individuals who owe money and those who are owed. At this point, however, the potential funding remains blocked by all the partisan animosity at Congress. Unless all the red tape is peeled back and a bipartisan funding agreement is reached the potential improvements for future tax years will remain in limbo.