The history of taxes and how it all started

Taxes are as old as civilization itself, a necessary cog in the wheel of organized societies. From ancient barter systems to today’s digital transactions, the evolution of taxation reflects the growth and complexity of human societies.

As we journey through history, we’ll explore how taxes have shaped economies, influenced politics, and even sparked revolutions. Buckle up for a fascinating ride through time, where money meets governance in intriguing ways.

Early Beginnings: The Dawn of Taxation

The concept of taxation dawned with the earliest organized communities, where communal projects required pooled resources. As societies transitioned from hunter-gatherer groups to agrarian communities, the need for a structured system of contribution emerged.

Early taxes were often paid in kind with crops or livestock, essential for supporting leaders and communal infrastructures. These primitive taxes laid the groundwork for more sophisticated systems that would develop in the centuries to come.

Ancient Egypt: The Pharaohs’ Tax Code

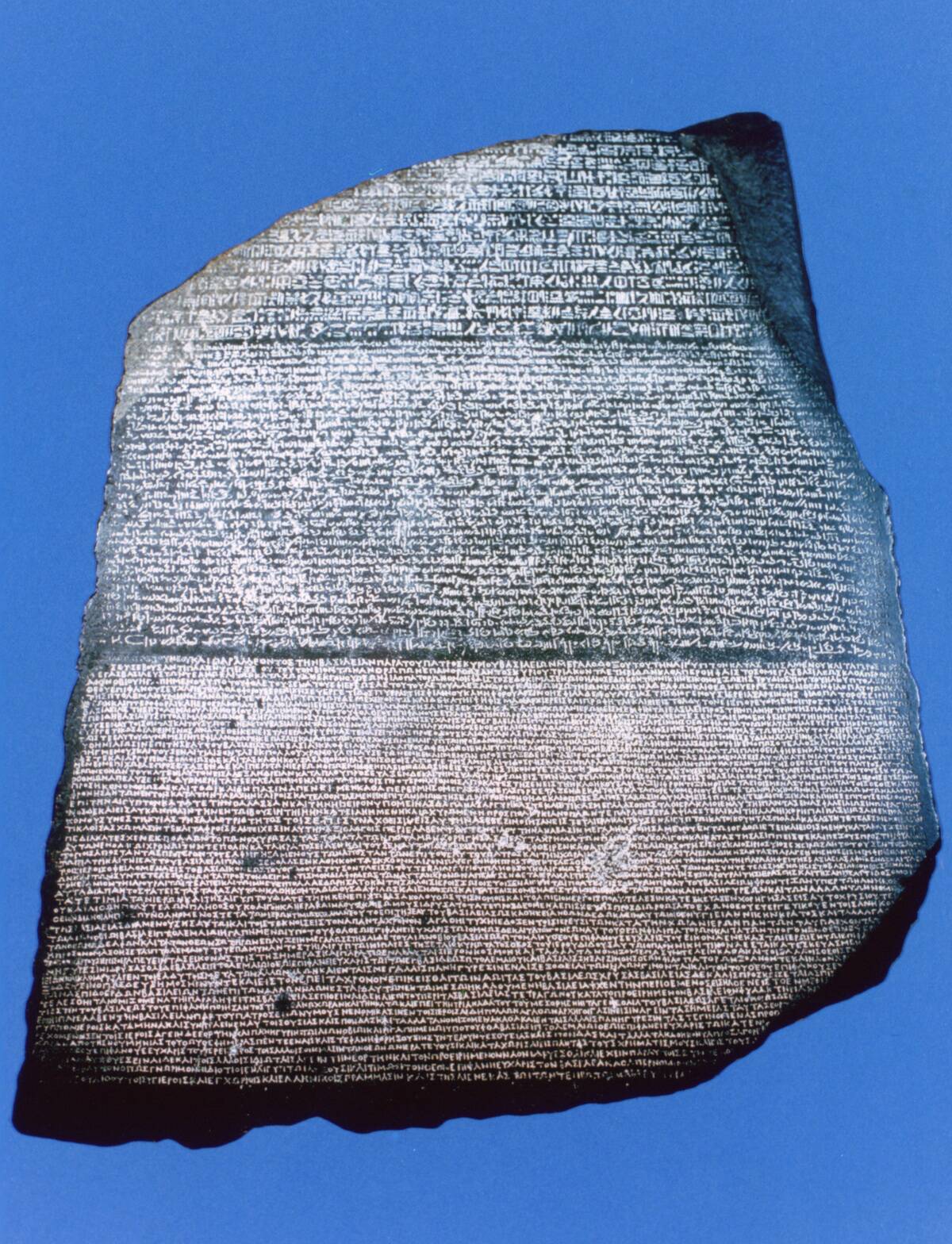

In ancient Egypt, taxes were crucial for maintaining the grandeur of the pharaohs’ reigns. Farmers were taxed on their agricultural produce, a system meticulously recorded by scribes. The famous Rosetta Stone even references tax exemptions granted by Pharaoh Ptolemy V.

These levies supported monumental construction projects, like the pyramids, and ensured the prosperity of the Egyptian state. It was a well-oiled machine, with tax collectors known as scribes playing a pivotal role.

Mesopotamia: The First Known Tax Records

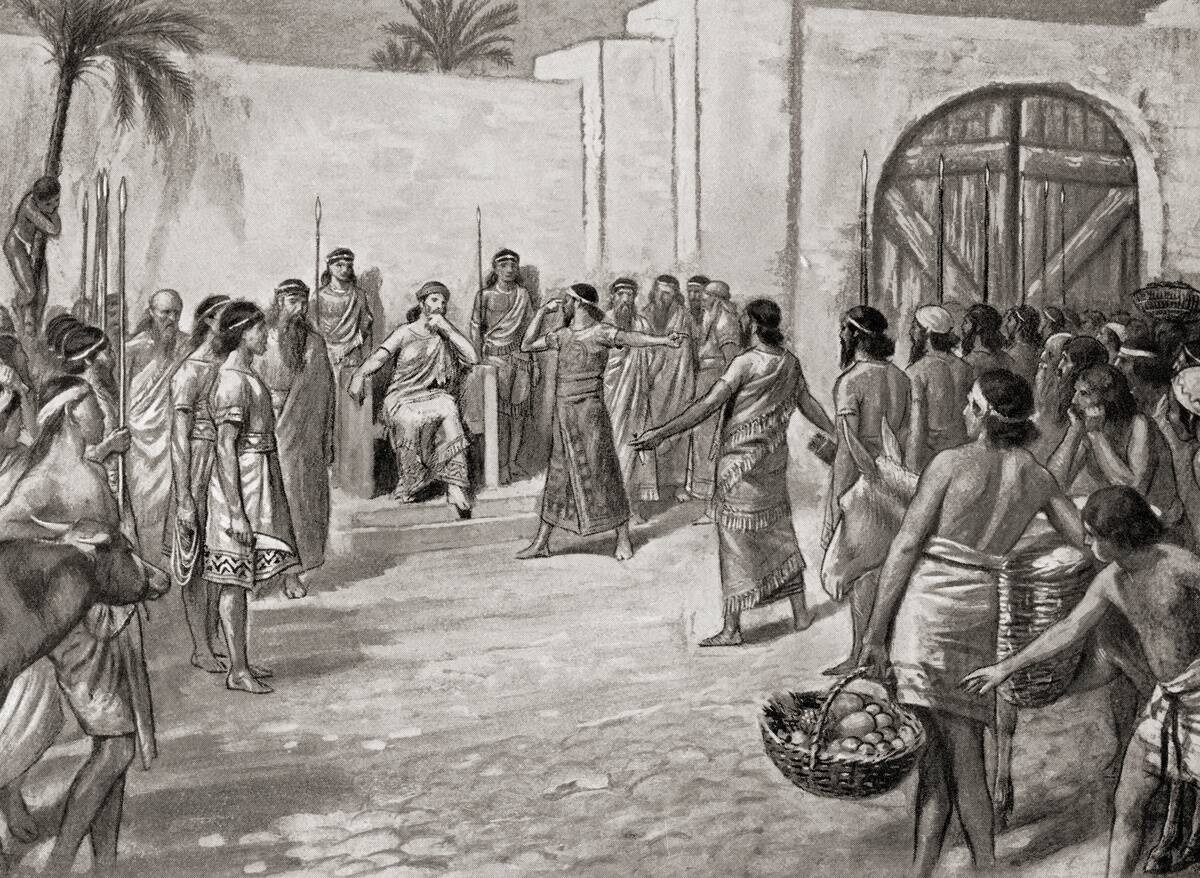

Mesopotamia, often dubbed the cradle of civilization, boasts the earliest known tax records. The Code of Hammurabi, one of the oldest deciphered writings, includes tax laws that governed the Babylonian Empire.

Taxes were paid in goods like grain, livestock, or silver, reflecting the agricultural backbone of the economy. These records highlight the importance of taxation in maintaining state stability and funding public works, a concept that would resonate through history.

Ancient Greece: Taxation in the Cradle of Democracy

Taxation in ancient Greece was as varied as its city-states. While Athens imposed taxes on imports and exports, known as ‘telos’, it also relied on wealthy citizens to fund public projects through a practice called ‘liturgies’.

This system not only supported the city-state’s infrastructure but also reinforced social hierarchies. The Athenians viewed taxes as a civic duty, ensuring the prosperity of their burgeoning democracy and culture.

Rome’s Tax Tactics: Funding an Empire

The Roman Empire’s tax system was instrumental in its expansion and maintenance. Romans introduced taxes on land, slaves, and even inheritance, allowing the empire to amass wealth and fund its military conquests.

The ‘tributum’ and ‘vectigal’ were primary tax forms, with complex assessments ensuring everyone paid their due. These taxes supported the empire’s vast infrastructure, from roads to aqueducts, showcasing Rome’s administrative might and its reliance on taxation.

Medieval Times: Knights, Kings, and Levies

In medieval Europe, taxes were a blend of feudal dues and royal levies. Monarchs taxed their subjects to fund wars and maintain their courts, a necessity in a time of constant conflict.

Feudal lords collected rents and services from vassals, who, in return, received protection. The ‘scutage’, a tax paid in lieu of military service, was common. These taxes supported the medieval social order, balancing power between kings and nobility.

The Magna Carta: A Taxpayer’s Triumph

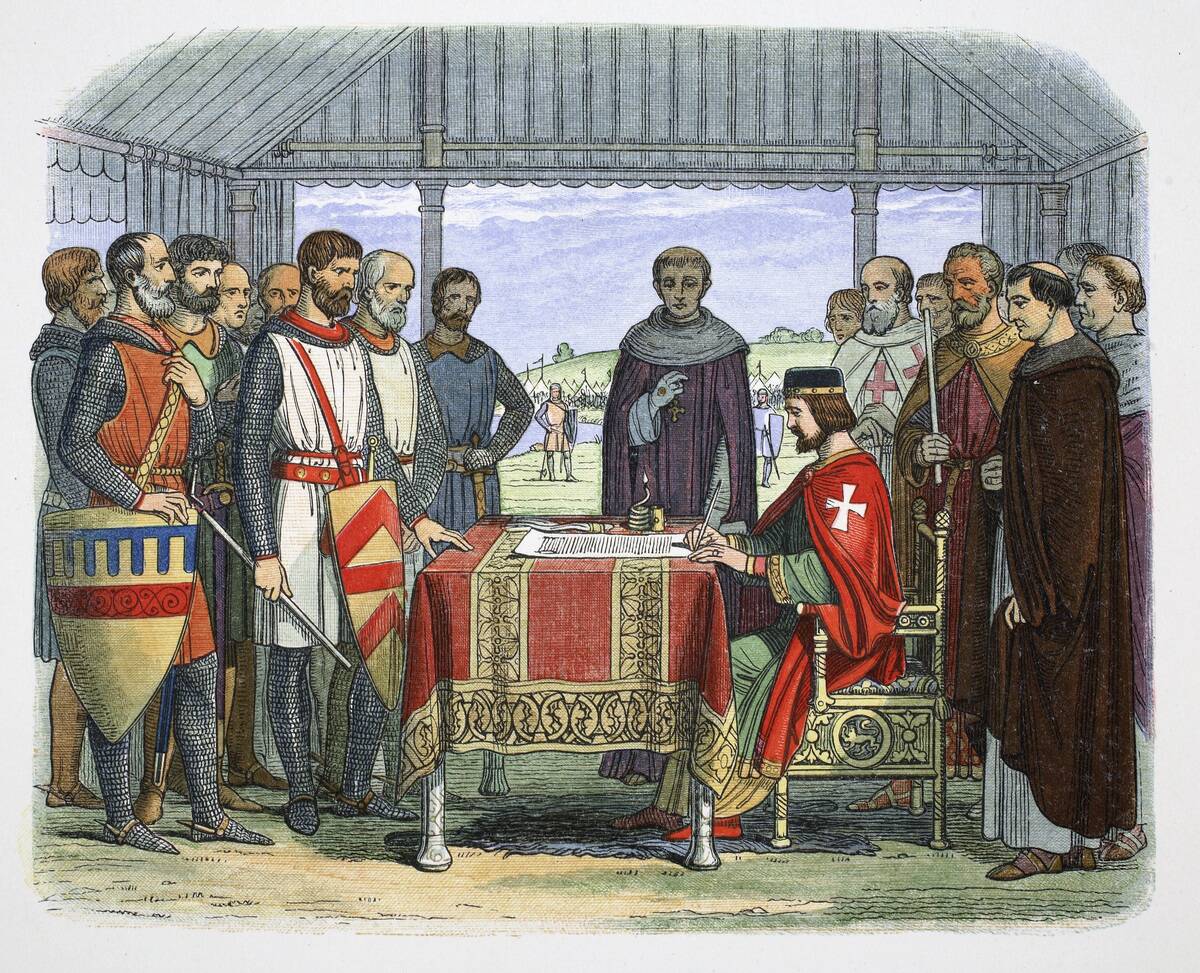

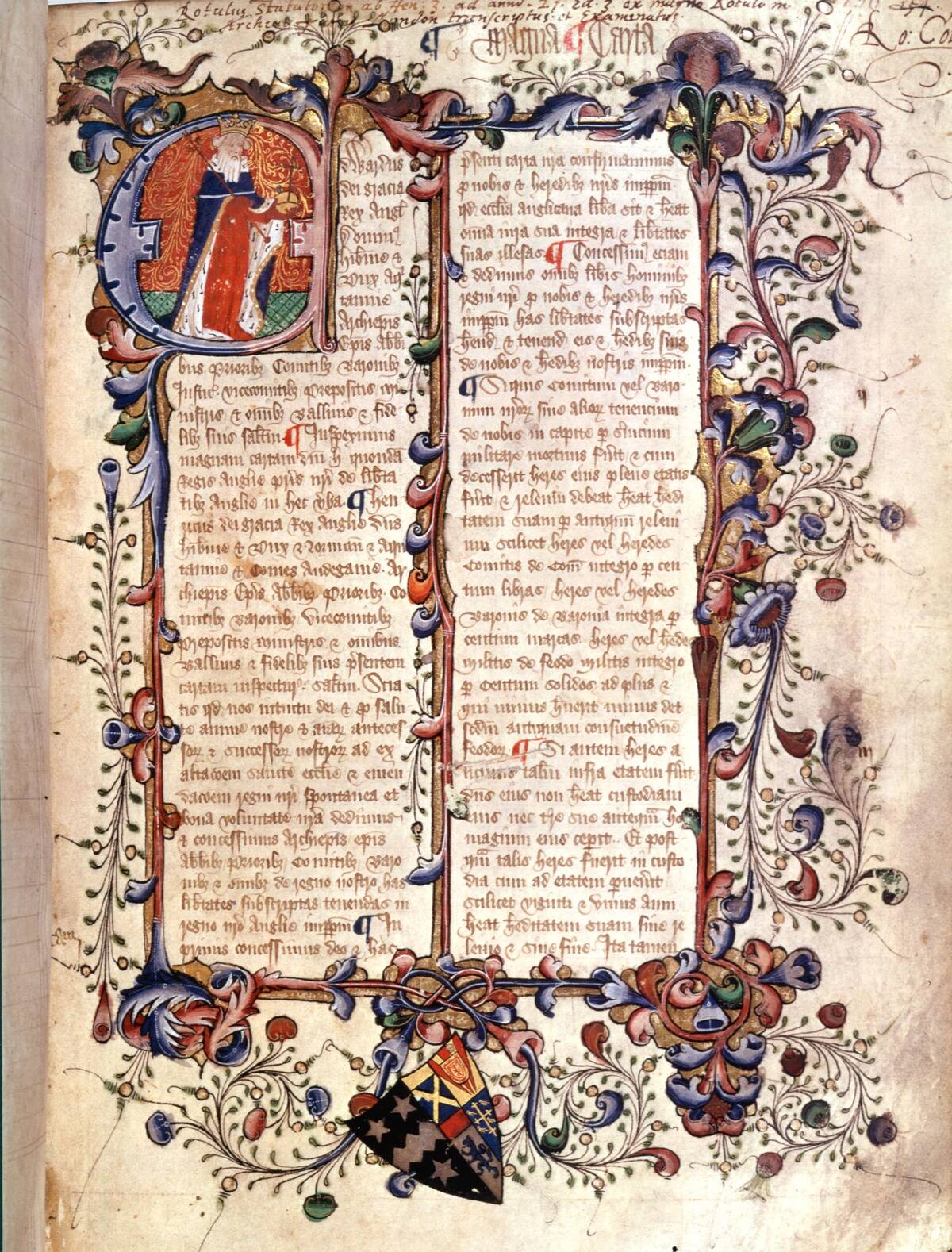

The Magna Carta of 1215 was a landmark document that limited the king’s power to levy taxes without baronial consent. This agreement between King John and his barons was a response to oppressive taxation and arbitrary rule.

It established the principle of ‘no taxation without representation’, influencing the development of constitutional governance. The Magna Carta is celebrated as a cornerstone of democratic ideals, emphasizing the importance of fair taxation.

Colonial America: Taxation Without Representation

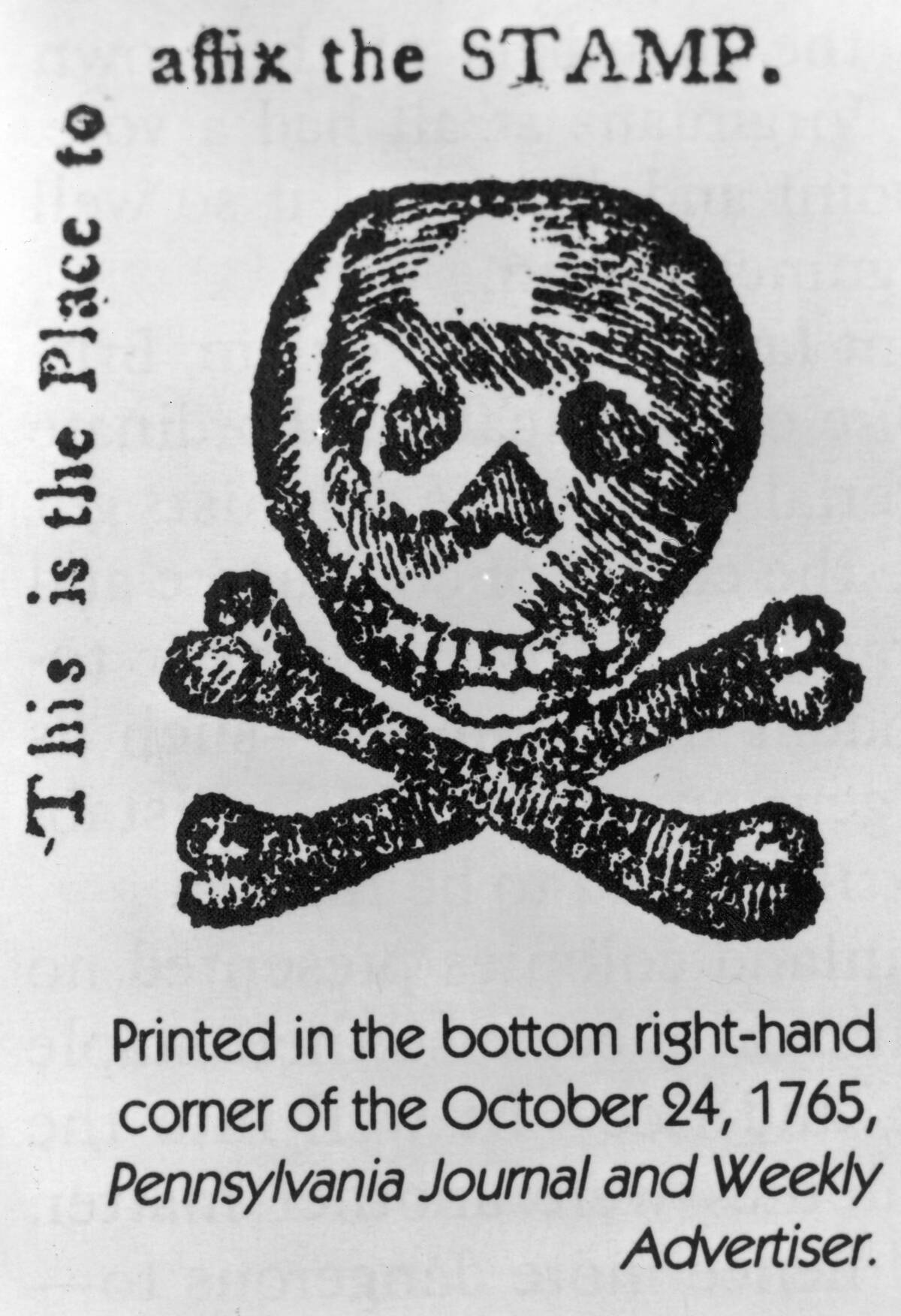

In colonial America, British taxes were a major grievance among settlers. The Stamp Act of 1765, taxing paper goods, and the Townshend Acts, taxing imports, were seen as unjust impositions.

Colonists argued they had no representation in Parliament, rallying around the slogan ’no taxation without representation’. These tensions fueled the desire for independence, setting the stage for the American Revolution and the birth of a new nation.

The Boston Tea Party: Brewing Tax Rebellion

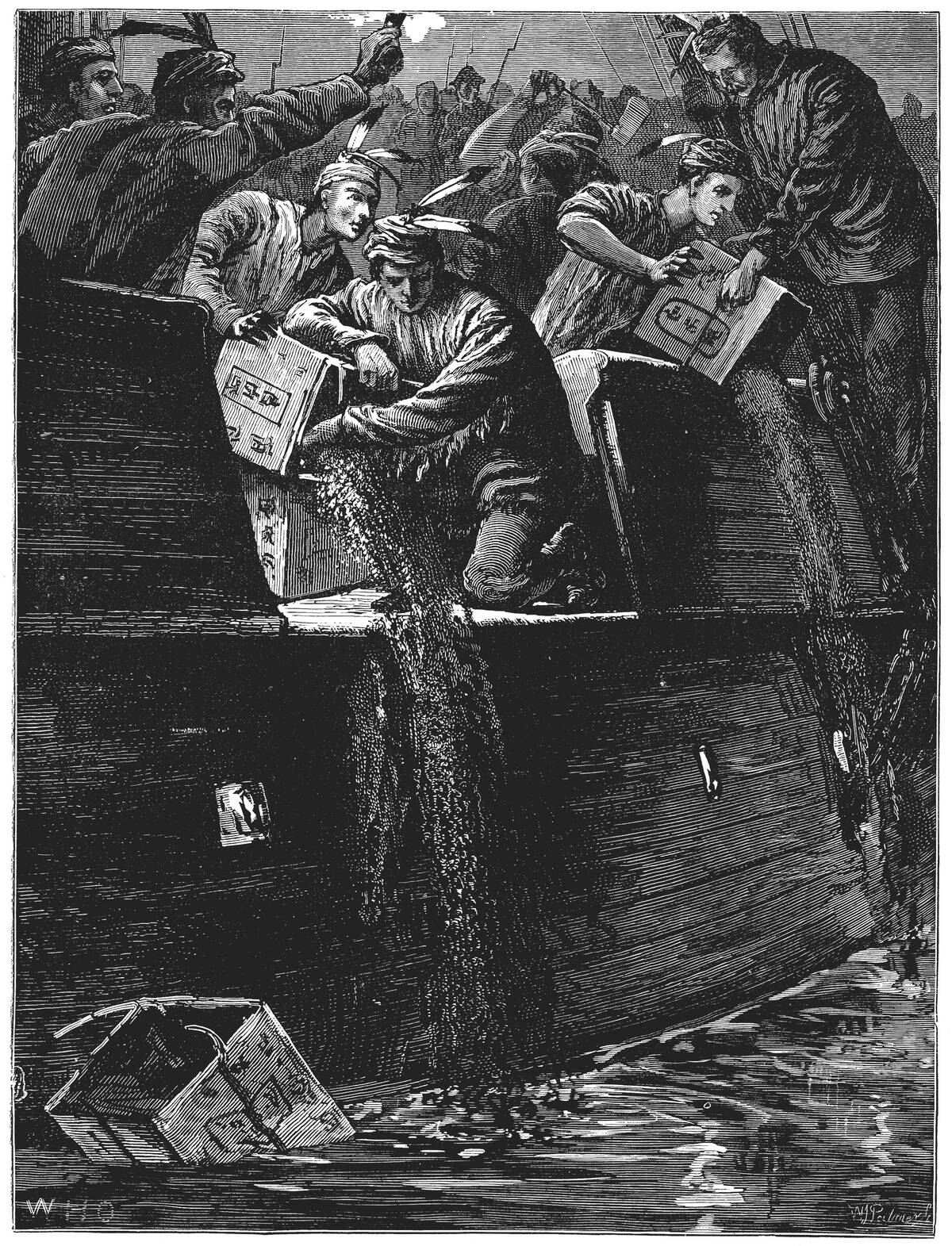

The Boston Tea Party of 1773 was a dramatic protest against British taxation. In response to the Tea Act, which granted the British East India Company a monopoly, colonists, disguised as Mohawk Indians, dumped an entire shipment of tea into Boston Harbor.

This act of defiance was pivotal, galvanizing colonial resistance and escalating tensions with Britain. It symbolized the colonists’ demand for self-determination and fair taxation practices.

18th Century Europe: The Age of Revolutions and Reforms

The 18th century in Europe was marked by revolutions, with taxation at the heart of many conflicts. The French Revolution was partly ignited by unfair tax burdens on the lower classes, while the nobility enjoyed exemptions.

Enlightenment ideas spurred calls for reform, leading to more equitable taxation systems. This era of upheaval and change reshaped European societies, integrating the concept of taxes as a tool for redistribution and fairness.

The Industrial Revolution: Taxing a New Era

The Industrial Revolution transformed economies and taxation systems. As industries boomed, governments shifted taxes from land to income and profits. The rise of urban centers necessitated new public services, funded by taxes on burgeoning businesses.

By the mid-19th century, some nations began introducing income taxes, and by the late 19th to early 20th centuries, progressive taxation emerged to address income disparities. The industrial age redefined taxation, aligning it with economic growth and social welfare, setting precedents for modern fiscal policies.

The Birth of Income Tax: A 19th Century Innovation

The concept of income tax emerged in the 19th century as a means to finance growing government expenses. The United Kingdom introduced it in 1799 to fund the Napoleonic Wars, setting a precedent for other nations.

Income tax became a permanent fixture in many countries, evolving to meet the demands of modern economies. It marked a significant shift from traditional tax bases, reflecting changes in societal structures and financial needs.

Wartime Taxes: Financing Conflict and Crisis

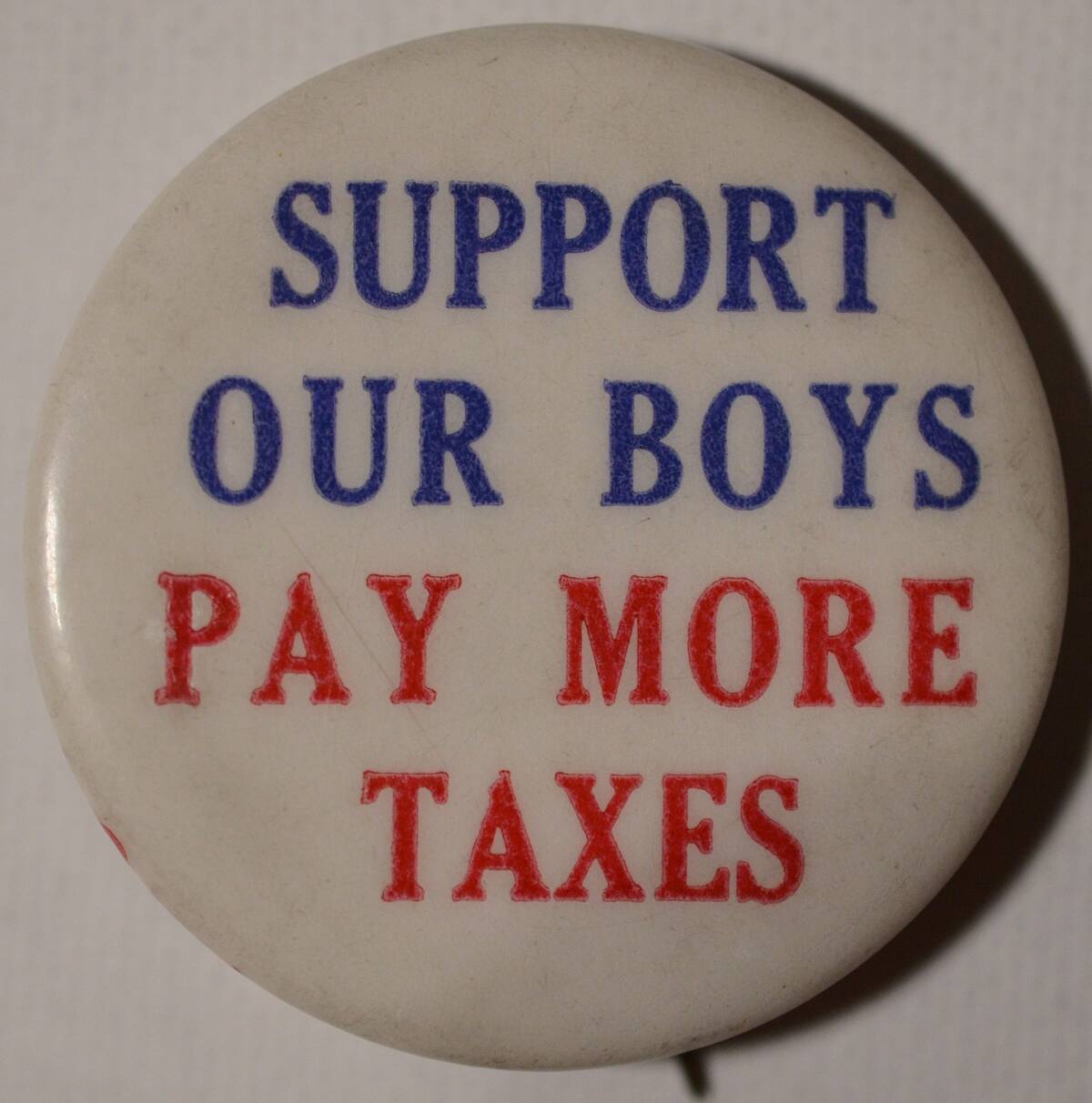

Wars have historically driven tax innovation to cover enormous costs. During the World Wars, countries introduced new taxes, such as excess profits taxes, to fund military efforts. Governments expanded tax bases and increased rates, relying heavily on public contributions.

These wartime measures often persisted post-conflict, reshaping national tax systems. The necessity of funding defense and reconstruction cemented the role of taxation in national security and economic stability.

Post-War Taxation: Building Back a Better World

Post-war periods required significant fiscal strategies to rebuild economies. The Marshall Plan, funded by the U.S. through taxes, helped revive European economies after World War II. Tax policies focused on economic growth and social welfare, laying foundations for modern welfare states.

Progressive taxation became more prominent, reflecting a commitment to reducing inequality. This era highlighted the power of taxes as tools for reconstruction and prosperity.

The 20th Century: Taxes in the Age of Technology

The 20th century brought technological advancements that transformed taxation. Computers revolutionized tax administration, improving efficiency and compliance. The introduction of value-added tax (VAT) in many countries responded to changing consumption patterns.

As economies became global, so did tax challenges, with multinational corporations navigating complex international tax laws. The digital age reshaped fiscal policies, requiring innovative solutions to keep pace with technological progress.

Modern Day Taxes: The Digital Finance Frontier

Today, taxes face the frontier of digital finance, with cryptocurrencies and online transactions challenging traditional systems. Governments are adapting by developing new regulations and tax frameworks for digital assets.

The OECD’s initiative on international tax reform aims to address issues like base erosion and profit shifting. In an increasingly digital world, taxation continues to evolve, ensuring governments can fund public services while fostering innovation and economic growth.