Financial crashes through history

Financial crashes have shaped economies and societies throughout history, leaving a trail of lessons and cautionary tales. From speculative bubbles to market melees, these events often stem from a mixture of overconfidence, greed, and unforeseen circumstances. While each crash is unique, they often share common themes, such as the rapid inflation of asset prices and subsequent loss of investor confidence. Understanding these patterns helps us navigate the unpredictable waters of the financial world.

The Tulip Mania of the 1630s: When Flowers Were Worth More Than Houses

In the 1630s, the Netherlands witnessed a frenzy over tulip bulbs, with prices soaring to astonishing heights. At the peak of Tulip Mania, a single bulb could fetch as much as ten times a skilled artisan’s annual income. However, this speculative bubble burst in 1637, leaving many investors in financial ruin. This early example of a market bubble serves as a vivid reminder of how irrational exuberance can lead to disastrous economic consequences.

The South Sea Bubble of 1720: The Stock That Sank the British Economy

The South Sea Company, established to trade in South America, saw its stock prices skyrocket in 1720 due to overly optimistic expectations and rampant speculation. Investors from all walks of life poured money into the company, hoping for massive returns. When reality failed to match the hype, the bubble burst, causing widespread financial devastation. This event highlighted the dangers of speculation and the importance of transparency in financial markets.

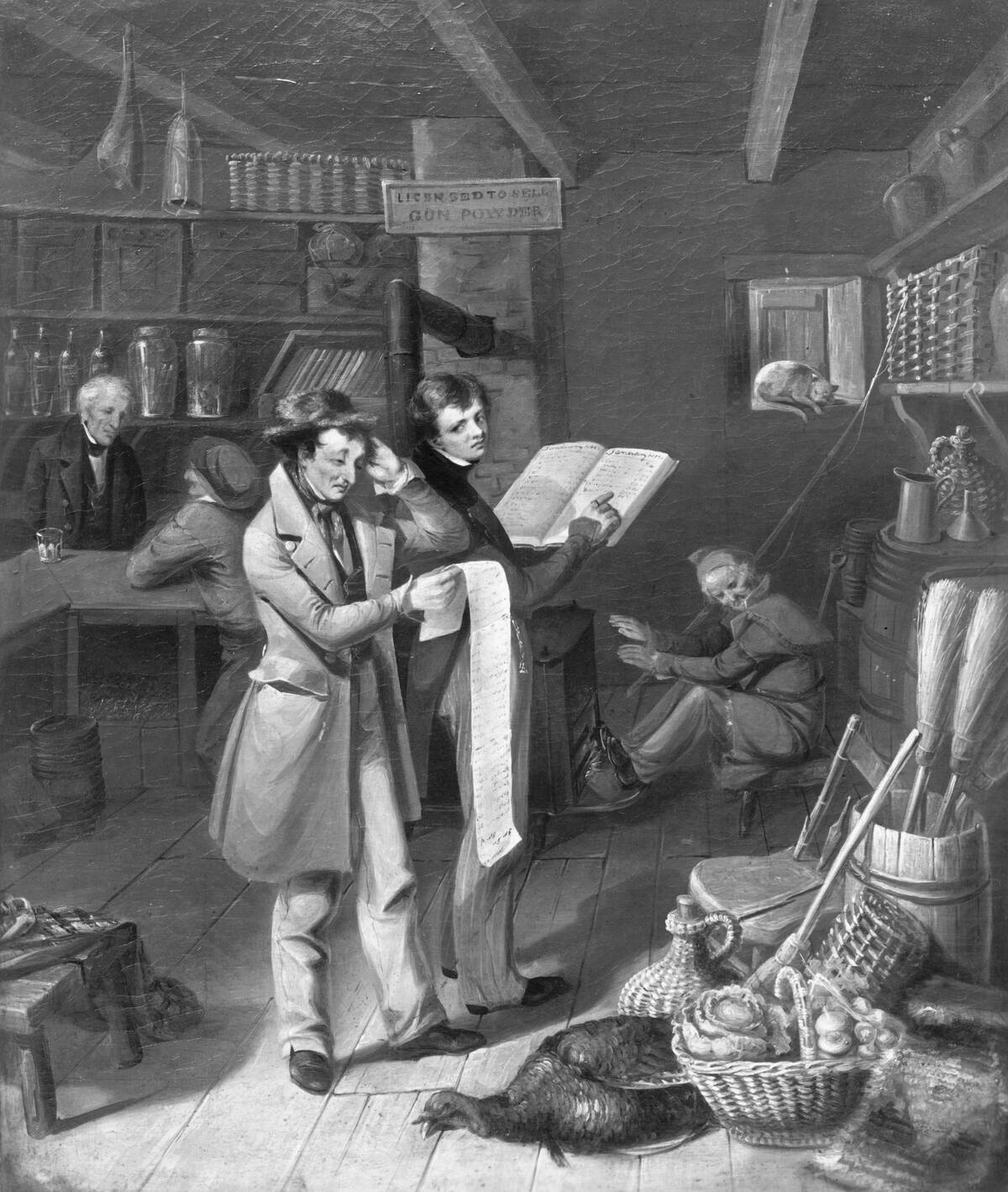

The Panic of 1837: A Crisis of Confidence in the American Economy

The Panic of 1837 was triggered by a combination of speculative lending practices, declining cotton prices, and restrictive monetary policies. President Andrew Jackson’s decision to dismantle the Second Bank of the United States also contributed to the instability. As banks failed and unemployment soared, the economy plunged into a deep recession. This panic underscored the need for a stable banking system to maintain economic confidence and growth.

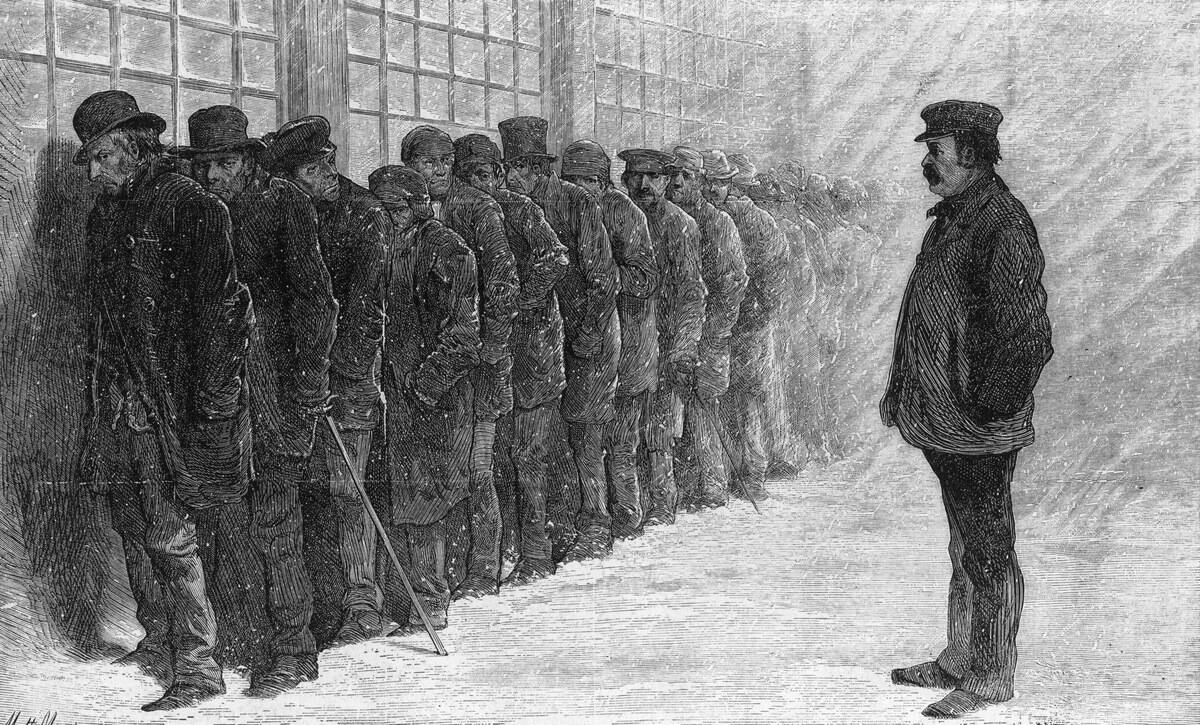

The Long Depression (1873-1899): Not So Long Ago, But Easily Forgotten

The Long Depression, beginning with the Panic of 1873, was a period of economic stagnation that affected Europe and the United States. It was marked by deflation, unemployment, and falling wages. The crisis started with the collapse of the Vienna Stock Exchange and was exacerbated by the failure of major banks and railroads. Despite its significant impact, this prolonged downturn is often overshadowed by later economic crises, yet it offers valuable insights into the challenges of economic recovery.

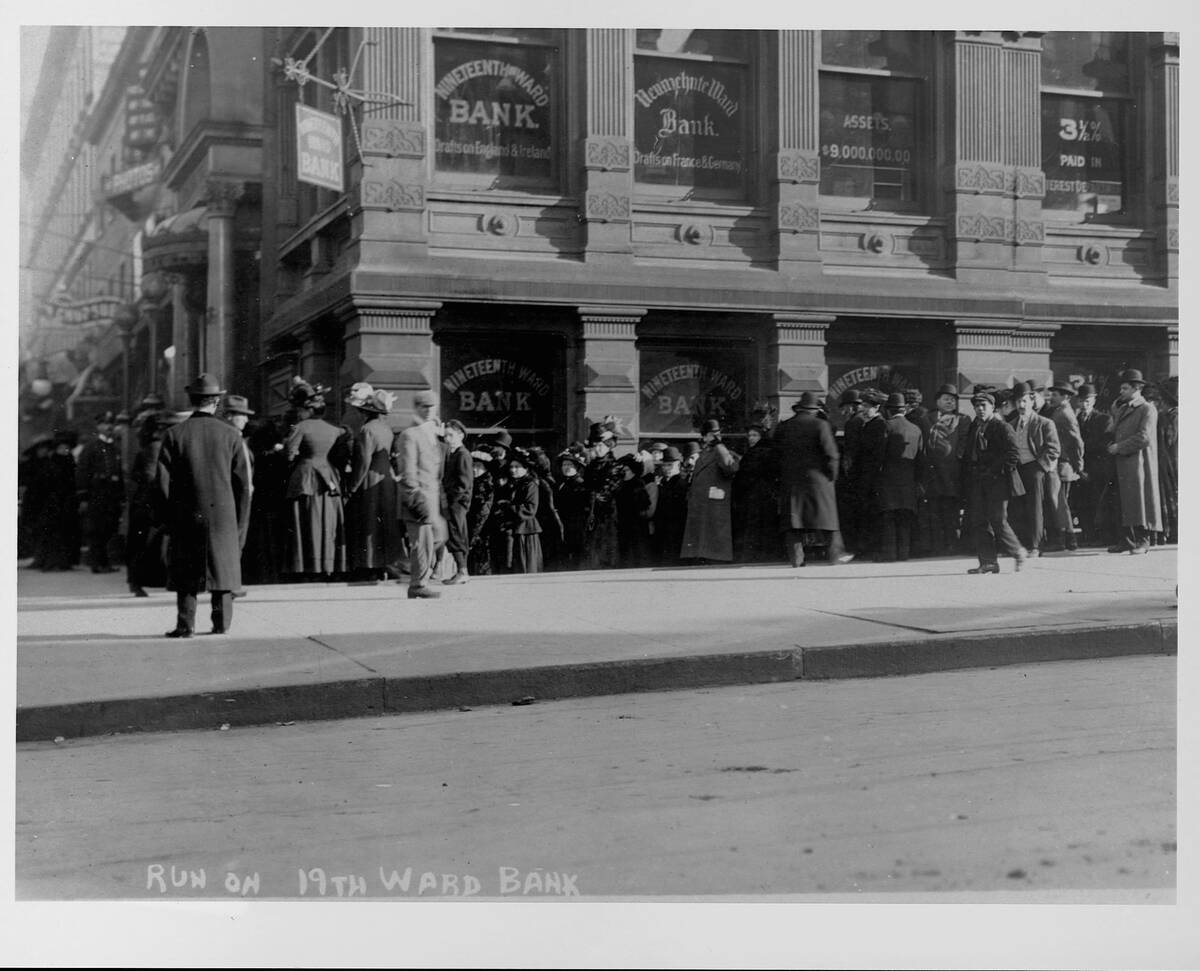

The Panic of 1907: When Wall Street Was Saved by a Banker

The Panic of 1907 was a financial crisis that saw the New York Stock Exchange plummet nearly 50% from its peak. The panic was halted by the intervention of J.P. Morgan, a prominent banker who organized a coalition of financiers to stabilize the banking system. This pivotal moment in financial history led to the creation of the Federal Reserve System in 1913, establishing a central bank to prevent future panics and promote economic stability.

The Wall Street Crash of 1929: The Great Depression Begins

The 1929 crash, known as Black Tuesday, marked the beginning of the Great Depression. Over-speculation in stocks and excessive use of margin buying led to an unsustainable bubble. When it burst, billions of dollars were lost, and the economic downturn spiraled into a worldwide depression. This catastrophic event reshaped economic policies and led to the implementation of New Deal reforms aimed at stabilizing and reviving the American economy.

The Recession of 1937-1938: A Setback in the New Deal Era

The Recession of 1937-1938 was a sharp economic downturn during the recovery from the Great Depression. It was triggered by fiscal tightening and reduced government spending, which were intended to balance the budget but inadvertently stifled economic growth. The downturn highlighted the delicate balance required in economic policy and the potential consequences of premature austerity measures. This episode reinforced the importance of maintaining fiscal support during economic recovery.

The Bretton Woods System Collapse (1971): When Gold Lost Its Shine

In 1971, President Richard Nixon announced the end of the Bretton Woods system, which had pegged the US dollar to gold and established fixed exchange rates. The decision, known as the “Nixon Shock,” led to the collapse of the system and the transition to floating exchange rates. This pivotal moment in monetary history marked the end of an era and reshaped the global financial landscape, influencing currency markets and international trade for decades to come.

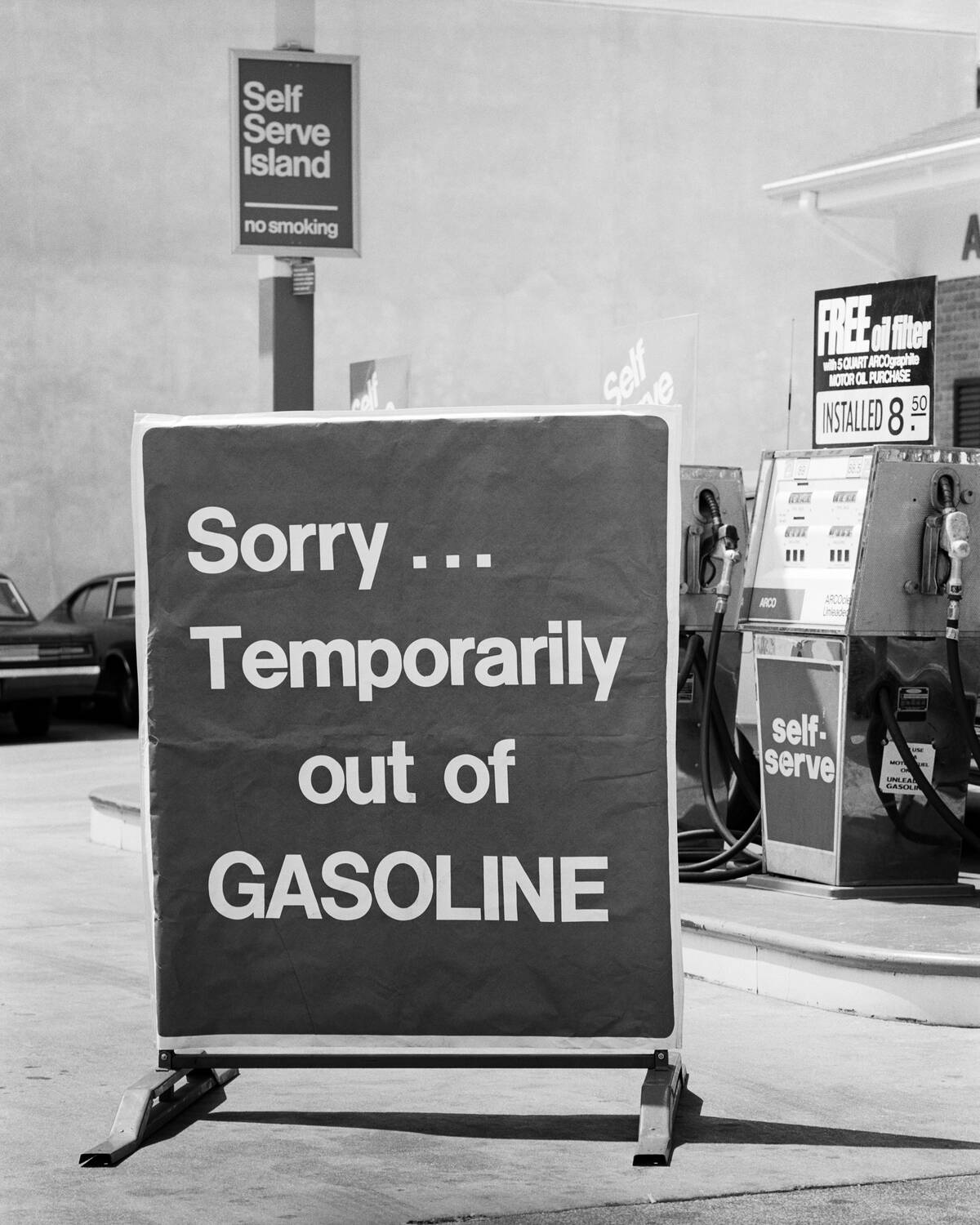

The Oil Crisis of 1973: When Gasoline Became Liquid Gold

The 1973 oil crisis was sparked by an oil embargo imposed by OPEC in response to U.S. support for Israel during the Yom Kippur War. As oil prices quadrupled, energy shortages became widespread, leading to inflation and economic stagnation. This crisis highlighted the world’s dependency on oil and prompted a shift towards energy conservation and diversification. The impact of this crisis is still felt today, as it underscored the geopolitical significance of energy resources.

Black Monday (1987): A Day That Shook the Stock Market

On October 19, 1987, global stock markets experienced a dramatic crash, with the Dow Jones Industrial Average plummeting 22% in a single day. Known as Black Monday, this event was exacerbated by computerized trading systems and investor panic. Despite the severity of the crash, the economy quickly recovered, thanks in part to swift actions by central banks. Black Monday served as a wake-up call for regulators and traders, highlighting the need for improved market mechanisms.

The Asian Financial Crisis (1997): When the Tiger Economies Stumbled

The Asian Financial Crisis began in 1997 when Thailand’s currency collapsed, setting off a chain reaction across Asia. The crisis exposed vulnerabilities in the region’s financial systems, including excessive borrowing and reliance on short-term foreign debt. Economies such as South Korea, Indonesia, and Malaysia faced severe recessions and currency devaluations. The crisis led to significant reforms and greater financial oversight in affected countries, as well as increased attention to the risks of rapid economic growth.

The Dot-com Bubble Burst (2000): When Tech Dreams Met Reality

The late 1990s saw a surge in technology stocks, fueled by the internet’s potential and speculative investment. As companies rushed to go public, valuations soared to unsustainable levels. In 2000, the bubble burst, wiping out trillions in market value and leading to a recession. This period highlighted the dangers of speculative bubbles and the importance of sustainable business models, leaving lasting lessons for investors and entrepreneurs in the tech industry.

The 2008 Global Financial Crisis: The Great Recession Unfolds

The 2008 financial crisis, sparked by the collapse of Lehman Brothers, was rooted in the housing market’s subprime mortgage debacle. As mortgage-backed securities lost value, financial institutions faced massive losses, leading to a credit freeze and global recession. Governments and central banks intervened with unprecedented measures to stabilize economies. This crisis prompted reforms in financial regulation and highlighted the interconnectedness of global financial systems, emphasizing the need for vigilance and transparency.

The Eurozone Crisis (2009-2012): A Sovereign Debt Drama in Europe

The Eurozone crisis was a complex financial turmoil that revealed the flaws in the European monetary union. Triggered by high sovereign debt levels in countries like Greece, Portugal, and Spain, the crisis led to bailouts and austerity measures. The situation exposed the challenges of having a unified currency without fiscal unity. While the crisis was eventually contained, it spurred debates about economic integration and the future of the European Union’s financial framework.