History’s most extreme economic crises

History has been peppered with economic ups and downs that have left lasting scars on nations and individuals alike. From exuberant booms to devastating busts, these financial roller coasters have shaped our world in unexpected ways. Join us as we journey through some of the most significant economic downturns in history, each with its own unique story and lessons to be learned.

The Tulip Mania: When Flowers Were Worth Their Weight in Gold

In the 17th century, the Netherlands experienced a frenzy over tulip bulbs, known as Tulip Mania. At its peak, a single bulb could cost more than a skilled craftsman’s annual salary. The market eventually crashed in 1637, illustrating the dangers of speculative bubbles. Despite the collapse, this event left an indelible mark on economic history as one of the first recorded speculative bubbles.

South Sea Bubble: Britain’s 18th Century Financial Fiasco

The South Sea Bubble was a financial scheme in the early 18th century that promised untold wealth from trade with South America. Investors flocked to buy shares, causing prices to skyrocket. However, when the bubble burst in 1720, many were left penniless. This debacle led to increased government regulation of the financial markets in Britain and remains a cautionary tale of unchecked speculation.

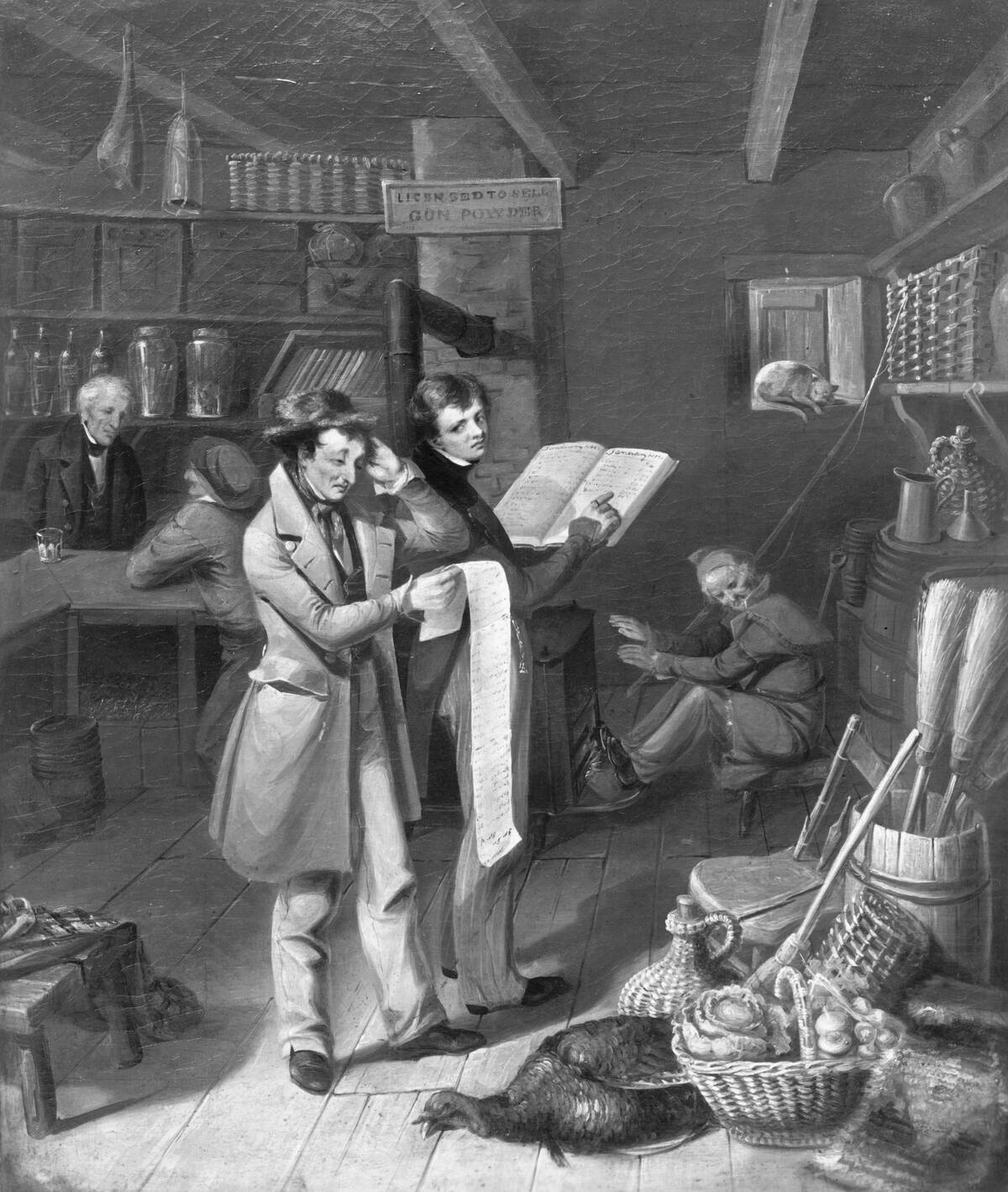

The Panic of 1837: America’s First Major Economic Meltdown

The Panic of 1837 was triggered by a combination of speculative lending practices and a collapse in cotton prices. It led to widespread bank failures and a significant economic depression in the United States. The crisis highlighted the need for a more stable financial system, paving the way for future reforms. This first major economic meltdown left a profound impact on the American psyche and economy.

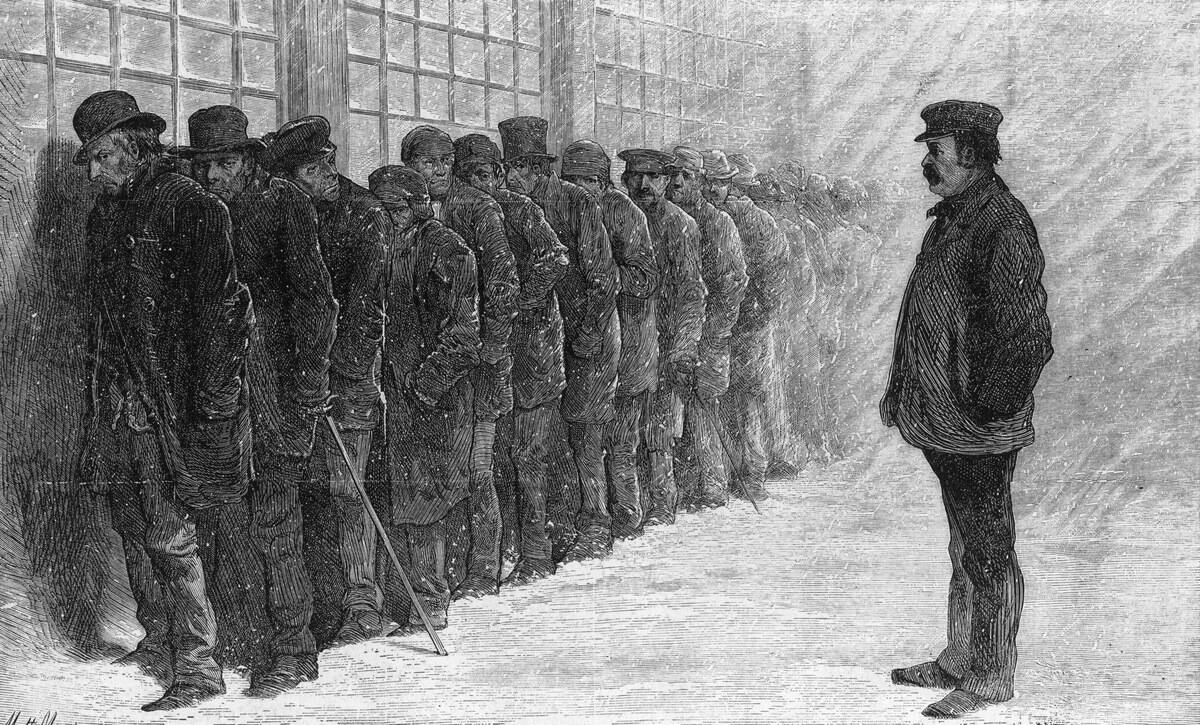

The Long Depression: A Gloomy 19th Century Slump

Spanning from 1873 to 1896, the Long Depression was a global economic downturn that mainly affected Europe and the United States. Triggered by a banking panic in Vienna, it led to widespread unemployment and deflation. The period saw the rise of new economic theories, including protectionism, as countries sought to shield themselves from global economic instability. Despite its name, it was not a continuous depression but a series of financial crises.

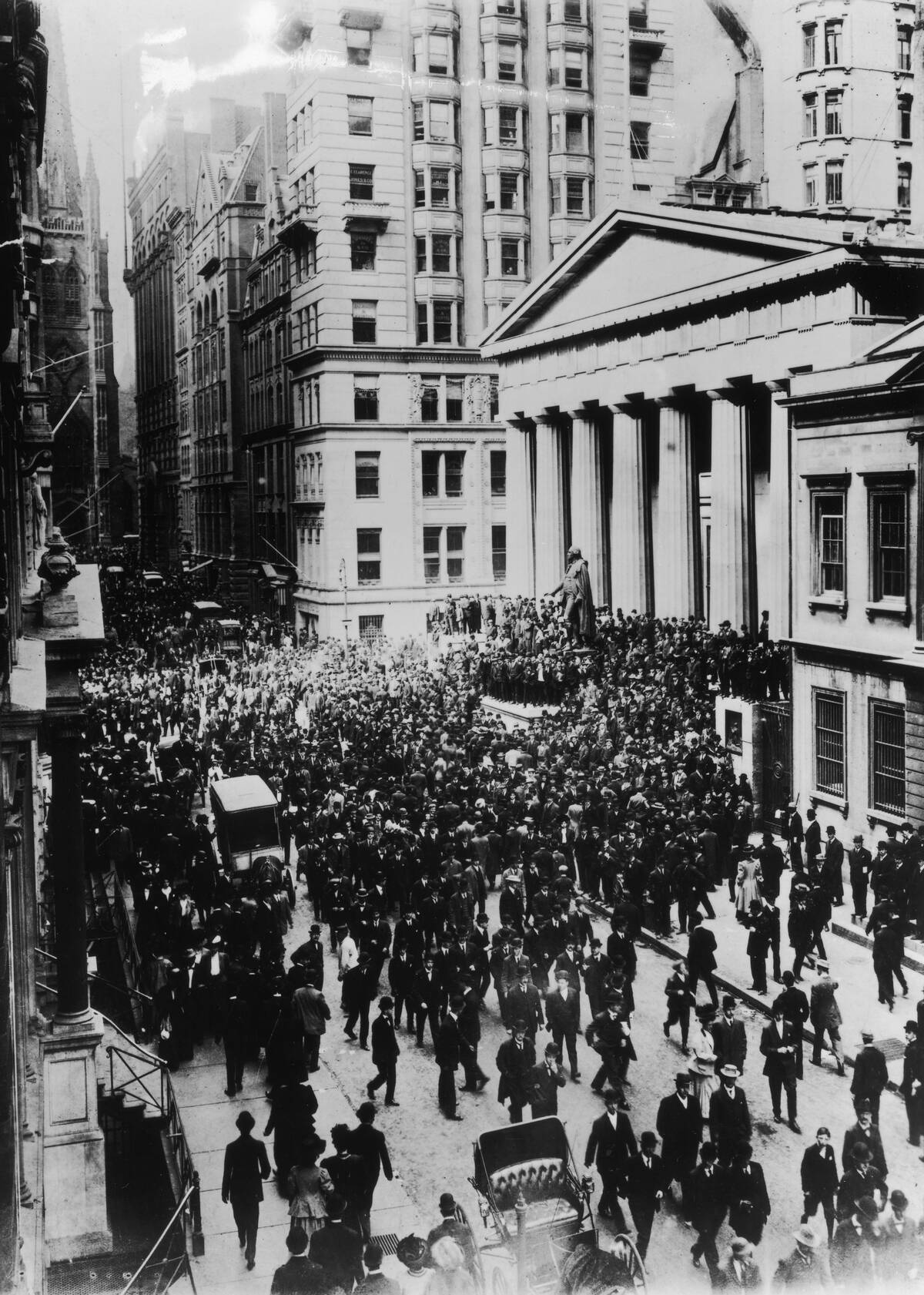

The Panic of 1907: The Crisis That Gave Birth to the Fed

The Panic of 1907 was a financial crisis in the United States that saw the stock market drop about 37% from its peak the previous year. It was exacerbated by a lack of central banking system to provide liquidity. This crisis led to the creation of the Federal Reserve System in 1913, designed to prevent future financial panics by providing a more stable and flexible monetary framework.

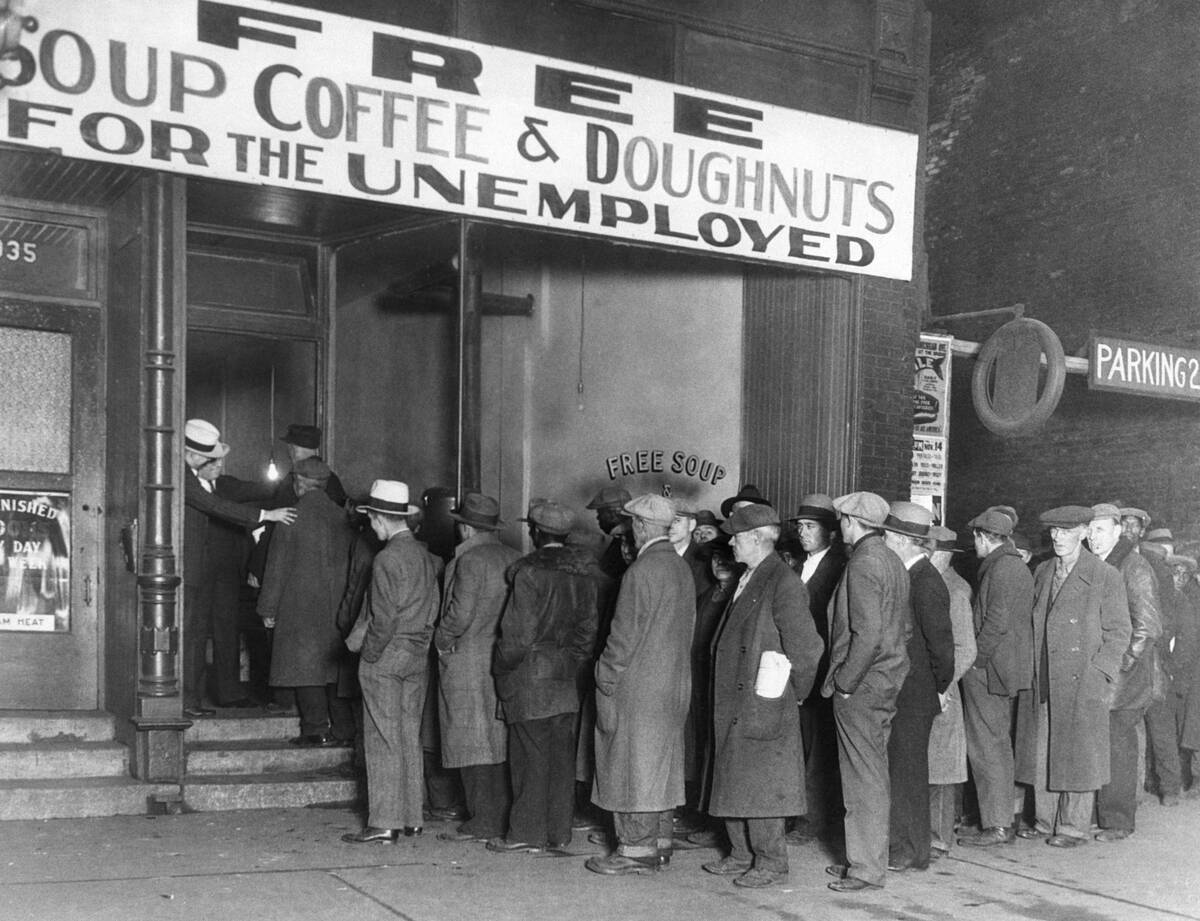

The Great Depression: The Big One That Shook the World

The Great Depression of the 1930s was the most severe economic downturn in modern history. Triggered by the 1929 stock market crash, it led to massive unemployment and poverty worldwide. Governments responded with a range of policies, including the New Deal in the United States, which aimed to stimulate the economy and provide relief. This era profoundly influenced economic policy and led to the development of modern welfare states.

Hyperinflation in Weimar Germany: When Money Became Wallpaper

Hyperinflation in Weimar Germany reached its peak in 1923, when prices doubled every few days. The German mark became so worthless that people used it as wallpaper or to fuel stoves. This economic chaos contributed to social unrest and set the stage for the rise of extremism. The lessons learned from this period are stark reminders of the dangers of uncontrolled inflation and its potential to destabilize societies.

The Asian Financial Crisis of 1997: A Tiger’s Tale of Turmoil

The Asian Financial Crisis of 1997 began in Thailand and quickly spread to other Asian nations, causing a severe economic downturn. Triggered by excessive borrowing and currency devaluations, it resulted in the International Monetary Fund stepping in with bailout packages. The crisis exposed vulnerabilities in the region’s economic structures and led to significant reforms aimed at increasing transparency and stability in the financial sector.

The Argentine Economic Crisis: An Odyssey of Inflation and Default

Argentina’s economic crisis in the early 2000s was characterized by soaring inflation, massive debt, and a default on $132 billion. The crisis was rooted in a fixed exchange rate system and unsustainable fiscal policies. It led to widespread poverty and social unrest. Since then, Argentina has struggled with recurring economic challenges, highlighting the complexities of managing an economy heavily reliant on foreign debt.

The Dot-Com Bubble: The Internet Dream That Went Pop

The Dot-Com Bubble of the late 1990s was fueled by speculative investments in internet-based companies. Stock prices soared, but by 2000 the bubble burst, wiping out trillions in market value. Many companies folded, while survivors like Amazon emerged stronger. This period underscored the importance of sustainable business models and marked a pivotal moment in technology’s integration into everyday life.

The 2008 Global Financial Crisis: When the World Stopped Spinning

The 2008 Global Financial Crisis was triggered by the collapse of the housing market in the United States, leading to a worldwide banking crisis. Governments and central banks intervened with unprecedented measures to stabilize financial systems. The crisis exposed flaws in financial regulations and led to major reforms, including the Dodd-Frank Act in the U.S., aimed at preventing a repeat of such catastrophic failures.

The Greek Debt Crisis: A Modern Trojan War on the Eurozone

The Greek Debt Crisis, which began in 2009, was marked by extreme austerity measures and bailout programs from the European Union and International Monetary Fund. Greece’s massive debt burden and budget deficits led to severe economic contraction and social unrest. This crisis tested the resilience of the Eurozone and highlighted the challenges of maintaining economic stability in a currency union with disparate fiscal policies.

Venezuela’s Economic Collapse: Oil Rich, Cash Poor

Venezuela, once one of the richest countries in Latin America, has faced an economic collapse largely due to plummeting oil prices and mismanagement. Hyperinflation has rendered the currency nearly worthless, leading to severe shortages of food and medicine. Millions have fled the country in search of better opportunities. This crisis underscores the risks of over-reliance on a single commodity and the importance of economic diversification.

The COVID-19 Recession: Pandemic Meets Economy

The COVID-19 pandemic triggered a global recession as lockdowns and restrictions disrupted economic activity worldwide. Governments responded with massive stimulus packages to support businesses and individuals. The crisis accelerated digital transformation and highlighted vulnerabilities in global supply chains. As countries recover, the pandemic has prompted a reevaluation of economic resilience and the importance of healthcare investments in sustaining long-term growth.