Frauds who convinced people they would change the world

Throughout history, the world has witnessed numerous frauds that have left an indelible mark on society. These deceptions, often orchestrated by charismatic individuals, have captivated the public’s imagination and, in some cases, altered the course of history.

From elaborate Ponzi schemes to audacious impersonations, these frauds provide fascinating insights into human nature and our unending quest for a better world. As we delve into these stories, we uncover a tapestry of ambition, deceit, and the perennial allure of a well-spun tale.

The Great Impostor: Ferdinand Waldo Demara

Ferdinand Waldo Demara, known as the Great Impostor, was a master of disguise and deception. He assumed various identities, including that of a doctor, a monk, and even a prison warden.

Demara’s most audacious feat came during the Korean War when he posed as a Royal Canadian Navy surgeon and performed complex surgeries despite having no medical qualifications. His story highlights the extraordinary lengths to which some individuals will go to live an adventurous life, relying on sheer audacity to bypass societal norms.

Gregor MacGregor’s Imaginary Land of Poyais

In the early 19th century, Gregor MacGregor convinced hundreds of investors to pour their savings into Poyais, a fictional Central American country he claimed to govern. MacGregor’s elaborate hoax included fake documents, maps, and even a guidebook published in London.

Despite the lack of evidence, his persuasive skills led many to embark on perilous journeys to this non-existent utopia. His story is a testament to how a well-crafted narrative, combined with a touch of grandeur, can exploit the dreams and gullibility of hopeful investors.

Elizabeth Holmes and the Theranos Deception

Elizabeth Holmes, once hailed as the next Steve Jobs, founded Theranos with the promise to revolutionize healthcare with a device that could run hundreds of tests on a single drop of blood. However, the technology was fundamentally flawed, and the company was built on a foundation of deception.

Despite attracting significant investment and media attention, Theranos collapsed in 2018, leaving behind a trail of lawsuits and shattered dreams. Holmes’ story is a cautionary tale about the dangers of overpromising and the importance of scientific integrity.

The Elaborate Hoax of Victor Lustig, the Man Who Sold the Eiffel Tower

Victor Lustig, a con artist of monumental audacity, is famous for “selling” the Eiffel Tower not once, but twice. Posing as a government official, he convinced scrap metal dealers that the iconic Parisian landmark was being dismantled.

Lustig’s charm and meticulous planning enabled him to pull off one of history’s most brazen scams. His life of deception, which included numerous other cons, demonstrates the power of persuasion and the lengths to which some will go to exploit human greed and naivety.

The Enigmatic Tale of Anna Sorokin, a.k.a. Anna Delvey

Anna Sorokin, better known as Anna Delvey, infiltrated New York City’s elite social scene by posing as a wealthy German heiress. Her lavish lifestyle, funded by fraudulent means, captivated the city’s movers and shakers until her web of lies unraveled in 2018.

Sorokin’s audacious deceit, involving fake bank statements and unpaid hotel bills, highlights the superficiality of certain social circles and the ease with which appearances can be deceiving. Her story is a modern-day reminder of the perennial allure of wealth and status.

Frank Abagnale: The Real-Life “Catch Me If You Can”

Frank Abagnale’s story of deception and redemption became famous through the film Catch Me If You Can. During the 1960s, Abagnale supposedly impersonated an airline pilot, a doctor, and a lawyer, successfully cashing millions of dollars in fraudulent checks before being caught by the FBI. It’s worth noting that Abagnale is the primary source for his daring stunts as an impostor, so the stints as a doctor and lawyer are unlikely to have taken place, and even the pilot claims may be exaggerated.

After serving prison time, he turned his life around and became a consultant for the FBI, using his expertise to help combat fraud. Abagnale’s tale is a fascinating look at the thin line between criminal ingenuity and legitimate skill.

The Enron Scandal: Corporate Fraud at its Peak

The Enron scandal, one of the most infamous corporate frauds in history, exposed the dark side of corporate greed and accounting malpractice. Once the seventh-largest company in the United States, Enron’s downfall in 2001 led to the loss of thousands of jobs and billions in shareholder value.

The company’s executives used complex financial statements to hide debt and inflate profits, ultimately leading to its bankruptcy. Enron’s collapse prompted significant reforms in corporate governance and accounting standards, highlighting the need for transparency and accountability.

Bernie Madoff’s Unbelievable Ponzi Scheme

Bernie Madoff orchestrated the largest Ponzi scheme in history, defrauding investors of an estimated $65 billion. For decades, Madoff promised consistent, high returns using a strategy that didn’t exist. The scheme collapsed during the 2008 financial crisis, revealing the depths of his deception.

Madoff’s operation, which targeted individuals, charities, and institutional investors, underscores the dangers of blind trust and the need for rigorous due diligence. His story serves as a stark reminder of the vulnerability of even the most sophisticated investors to financial fraud.

The Rise and Fall of the Fyre Festival

The Fyre Festival, billed as a luxury music festival in the Bahamas, quickly became a symbol of disaster and fraud. Promoted by influencers and celebrities, the event promised opulence but delivered chaos, with attendees stranded without basic amenities.

The festival’s organizer, Billy McFarland, was sentenced to prison for fraud, leaving countless lawsuits in its wake. The Fyre Festival saga is a cautionary tale of the power of social media marketing and the importance of transparency and proper planning in event management.

Charles Ponzi: The Original Ponzi Scheme Mastermind

Charles Ponzi, the namesake of the Ponzi scheme, promised investors extraordinary returns by exploiting international postal reply coupons. In reality, Ponzi used funds from new investors to pay older ones, creating the illusion of profitability.

His scheme unraveled in 1920, causing significant financial losses. Ponzi’s legacy endures as a textbook example of financial fraud and serves as a warning against investments that seem too good to be true. His story illustrates the perennial human susceptibility to the allure of quick and easy wealth.

The Mystifying Story of Clark Rockefeller

Clark Rockefeller, whose real name is Christian Karl Gerhartsreiter, managed to deceive the world into believing he was a member of the famous Rockefeller family. Over several decades, he assumed multiple identities, including that of a wealthy art dealer.

His charm and intelligence allowed him to navigate high society circles until his arrest in 2008. Rockefeller’s story is a fascinating study of identity manipulation and the power of social engineering, showcasing how easily perceptions can be crafted and maintained with confidence and cunning.

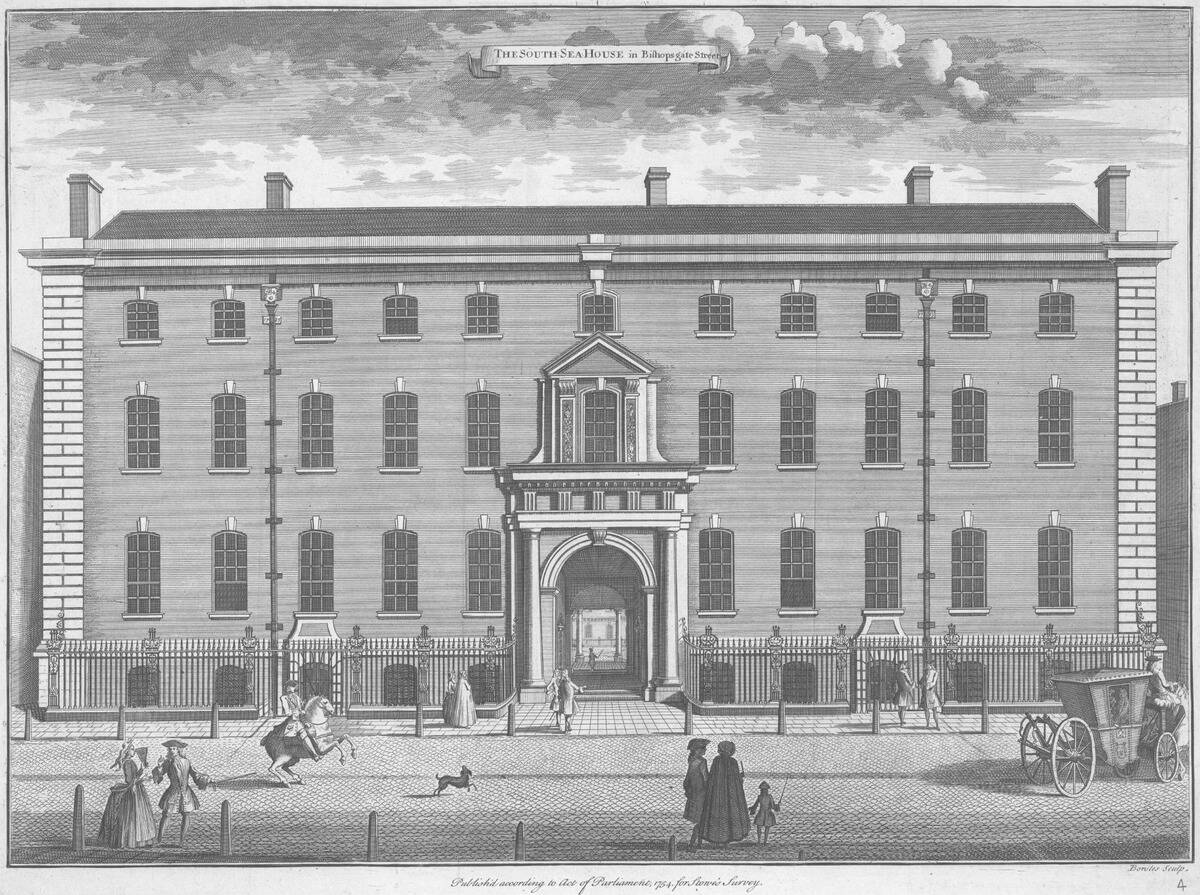

The False Promises of the South Sea Company

The South Sea Company, founded in the early 18th century, promised immense profits from trade with South America. The speculative frenzy surrounding the company’s stock led to a financial bubble that burst in 1720, leaving many investors ruined.

The South Sea Bubble highlighted the perils of speculative investments and the impact of market manipulation. It also prompted early regulatory reforms, laying the groundwork for modern financial markets. This historical episode underscores the cyclical nature of financial greed and the eternal quest for wealth.

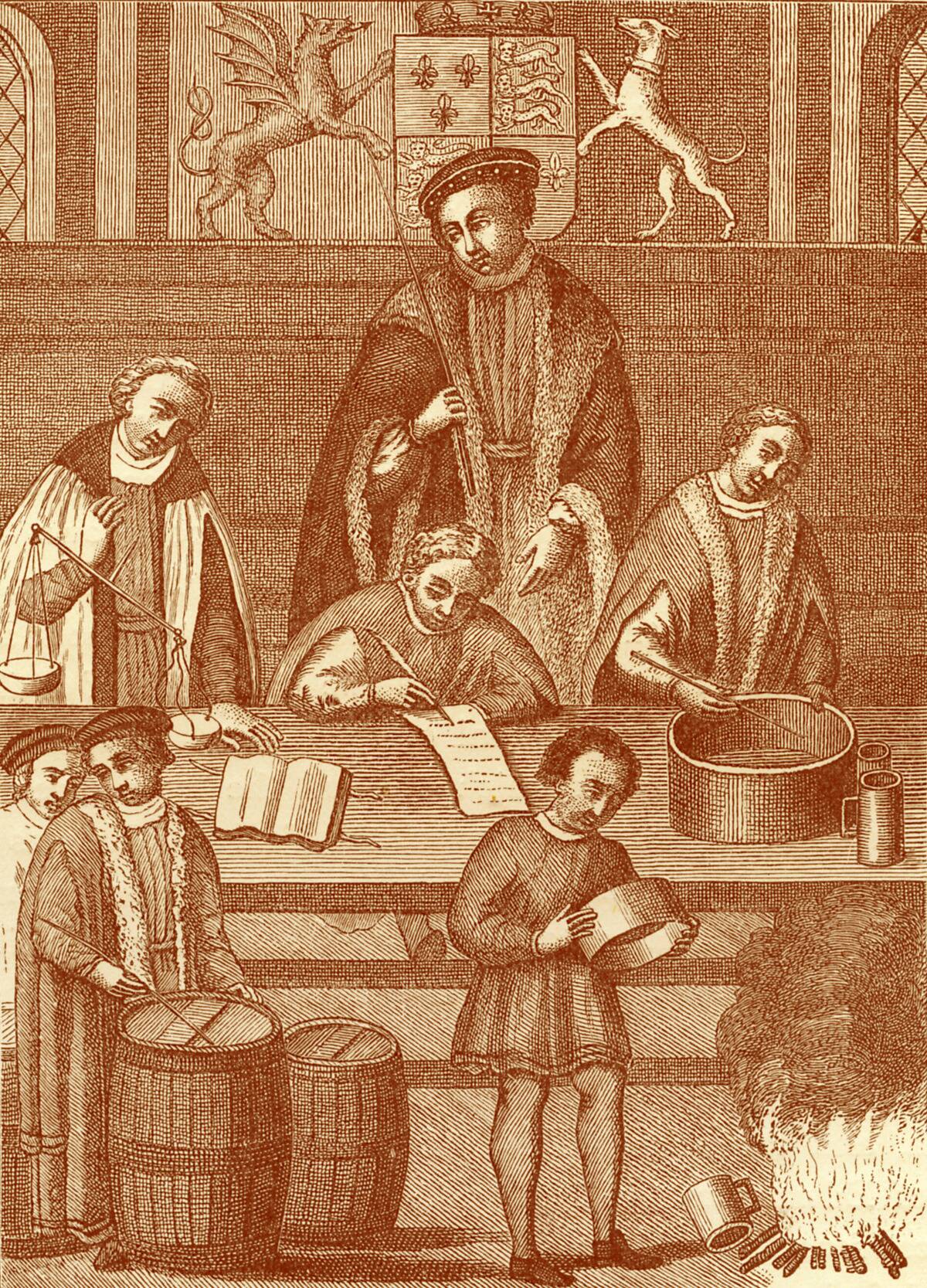

William Chaloner: The Counterfeit Con Artist of the 17th Century

William Chaloner was a notorious counterfeiter in 17th-century England, known for his skillful production of fake coins. Despite multiple arrests, Chaloner’s charm and cunning often won him leniency from the courts, as he often muddied the waters by accusing his accusers of fraudulently smearing him.

His criminal activities eventually caught the attention of Sir Isaac Newton, then Warden of the Royal Mint, who meticulously gathered evidence to secure Chaloner’s conviction and execution in 1699. Chaloner’s story illustrates the historical challenges of maintaining currency integrity and the relentless pursuit of justice by those dedicated to protecting it.

The Curious Case of L. Ron Hubbard and Scientology

L. Ron Hubbard, the founder of Scientology, created a religion that has sparked both devotion and controversy. Originally a science fiction writer, Hubbard introduced a belief system centered around the idea of spiritual enlightenment through a process called auditing.

While many followers view Scientology as a path to personal growth, critics argue that its practices are exploitative and financially burdensome. Hubbard’s legacy is a complex tapestry of intriguing narratives, raising questions about the nature of belief and the influence of charismatic leadership.