How currency evolved from barter to digital forms

Currency has been an essential part of human civilization, evolving from simple trade systems to complex digital transactions. The journey from bartering goods to the digital cryptocurrencies of today highlights humanity’s constant drive for efficiency and innovation in trade.

Understanding this evolution not only provides insight into economic history but also sheds light on the future of financial exchanges.

The Dawn of Barter Systems

Long before coins and paper bills, people engaged in barter systems, exchanging goods and services directly. For instance, a farmer might trade wheat for a potter’s clay jars.

However, bartering posed challenges, such as the need for a double coincidence of wants—both parties needed to desire what the other offered. This limitation eventually prompted the search for more efficient trade methods.

The Emergence of Commodity Money

Commodity money brought a new dimension to trade, using items with intrinsic value like salt, cattle, or shells as a medium of exchange. For example, ancient Mesopotamians used barley as a common currency.

These commodities had value and were widely accepted, bridging the gap in barter trade and paving the way for standardized monetary systems.

The Role of Precious Metals in Ancient Economies

Precious metals like gold and silver became prominent in ancient economies due to their durability and intrinsic value. Ancient Egypt used gold bars as currency, while the Roman Empire minted silver denarii.

These metals held universal appeal and were easier to transport and divide, making them a reliable medium for trade across regions.

The Introduction of Coins: A Revolutionary Step

The introduction of coins marked a significant advancement in currency systems. Around 600 BCE, the Lydians in modern-day Turkey minted the first coins, made from electrum, a gold-silver alloy.

Coins standardized trade by providing a consistent value measure, simplifying transactions and enhancing economic interactions across vast territories.

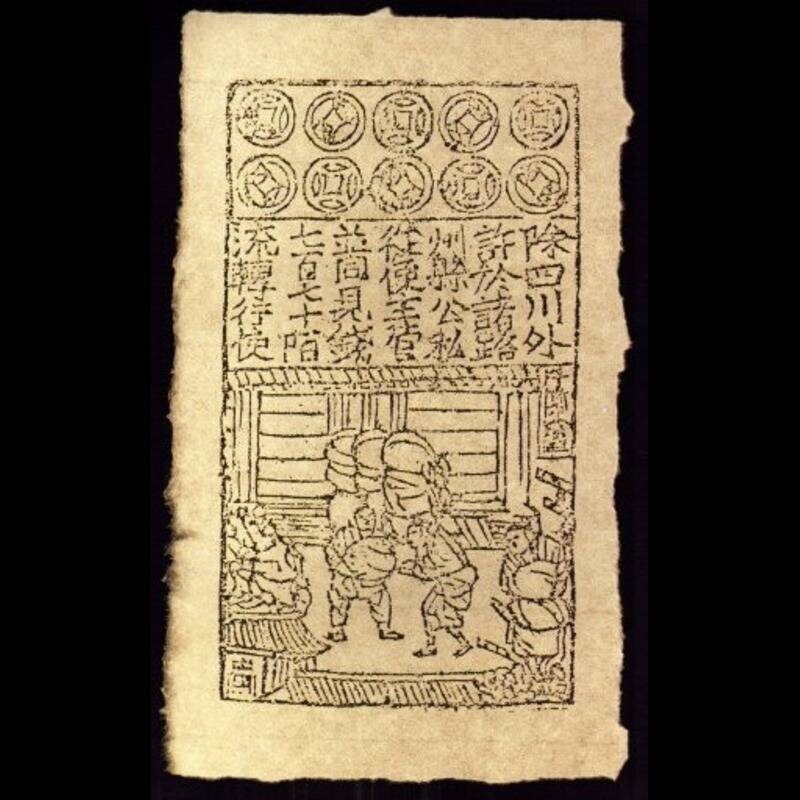

Paper Money: The Lightweight Solution

The advent of paper money offered a portable alternative to heavy metal coins. China’s Song Dynasty, in the 10-11th century, pioneered the use of paper currency, which spread to Europe much later.

This innovation reduced the burden of carrying large quantities of coins and facilitated larger transactions, revolutionizing commerce and paving the way for modern banking.

The Rise of Banking and Paper Currency

As paper money gained popularity, banking institutions emerged to manage and distribute currency. The 17th century saw the establishment of the Bank of England, which issued banknotes backed by gold reserves.

This development enhanced financial stability and trust, allowing economies to expand and diversify with greater ease and security.

The Gold Standard: A Brief Overview

The gold standard established a system where currency value was directly linked to gold. By the 19th century, major economies embraced this system, ensuring that paper money could be exchanged for a fixed amount of gold.

This provided a stable currency value but also limited monetary policy flexibility, contributing to its eventual decline in the 20th century.

The Birth of Fiat Money

Fiat money, unlike commodity-based currencies, derives its value from government decree. This system gained traction in the 20th century as nations moved away from the gold standard.

With fiat currency, governments could better manage economic policy, although it also introduced challenges such as inflation control and the need for monetary regulation.

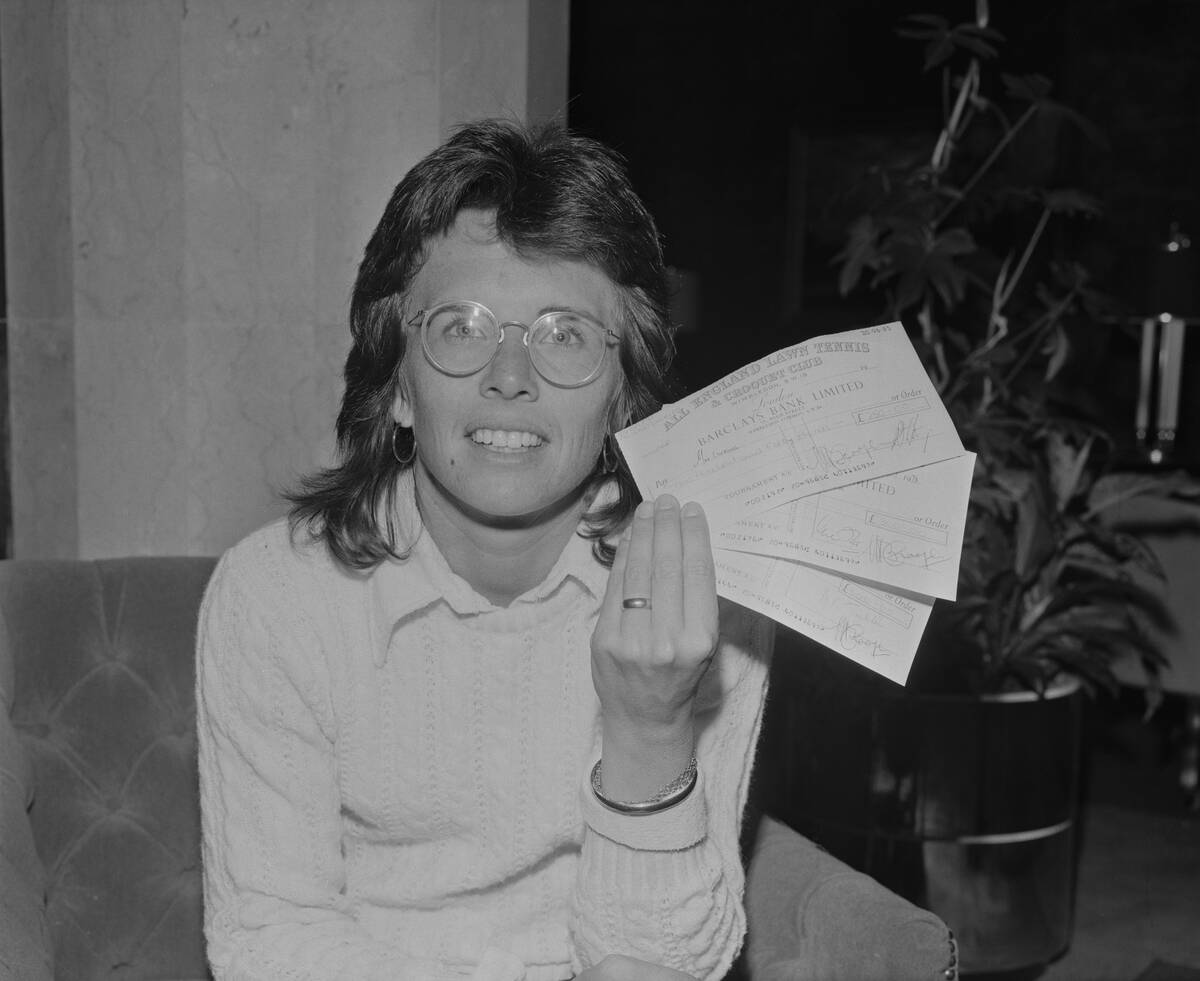

Checks and Balances: The Advent of Cheques

Cheques introduced a new dimension to personal and business transactions, offering a secure way to transfer large sums without physical cash.

Originating in the 9th century, their popularity surged in the 20th century, providing a convenient alternative to carrying paper money and laying groundwork for modern electronic transactions.

Credit Cards: Swiping into the Future

Credit cards revolutionized consumer spending by offering a cashless and convenient payment method. Introduced in the 1950s, they quickly gained traction, allowing users to buy now and pay later.

This innovation not only enhanced purchasing power but also fueled consumerism, leading to the development of global financial networks and credit systems.

The Birth of Online Banking

Online banking emerged in the late 20th century, transforming how people manage money. With the click of a button, users could transfer funds, pay bills, and monitor accounts from anywhere with internet access.

This convenience accelerated banking accessibility, reducing the need for physical branches and paving the way for digital financial services.

The Introduction of Digital Payment Platforms

Digital payment platforms, such as PayPal and Venmo, have become integral to modern commerce. These platforms offer fast, secure transactions without traditional banking constraints.

By linking directly to bank accounts or credit cards, they provide a seamless user experience, enabling instant transfers and simplifying online shopping and peer-to-peer payments.

Cryptocurrency: The Birth of Bitcoin

Bitcoin introduced the world to cryptocurrency in 2009, marking a shift towards decentralized digital currencies. Created by an anonymous entity, Satoshi Nakamoto, Bitcoin operates on a peer-to-peer network, independent of central banks.

This innovation challenged traditional financial systems, sparking debates and inspiring the development of hundreds of alternative cryptocurrencies.

Digital Coins and Blockchain Technology

Blockchain technology underpins cryptocurrencies, providing a secure and transparent transaction ledger. This innovation ensures data integrity and eliminates the need for intermediaries.

Ethereum expanded blockchain’s potential by enabling smart contracts, self-executing agreements coded into the blockchain, further diversifying its applications beyond digital currency.

The Rise of Altcoins: Beyond Bitcoin

Following Bitcoin’s success, numerous alternative coins, or altcoins, emerged, each offering unique features. Ethereum, known for smart contracts, and Litecoin, praised for faster transaction times, are notable examples.

These altcoins contribute to a vibrant crypto market, offering investors and users diverse options tailored to specific needs or technological innovations.